Refinancing With a Different Lender: What You Must Know

I’ve spent over 15 years in the mortgage industry, and if there is one thing that consistently costs homeowners money, it’s the “Loyalty Penalty.”

We tend to bank where we’ve always banked. It feels safe, familiar, and—let’s be honest—switching feels like a headache. You imagine piles of paperwork, endless phone calls, and digging through filing cabinets. But in my experience, that loyalty often comes with a hefty price tag. Your current lender has no real incentive to offer you the absolute floor rate; they already have your business.

The truth is, refinancing with a different lender is often the only way to unlock significant savings, better terms, or access to cash for renovations. The market has changed. Checking if the grass is actually greener doesn’t require spending hours on the phone anymore.

I often tell my clients to start by looking at the numbers objectively. Tools like Bluerate have completely changed how we shop for loans. You can check real-time rates and run different scenarios specifically for your financial situation instantly—without the commitment. But before we dive into the tools, let’s break down exactly what happens when you decide to break up with your current bank.

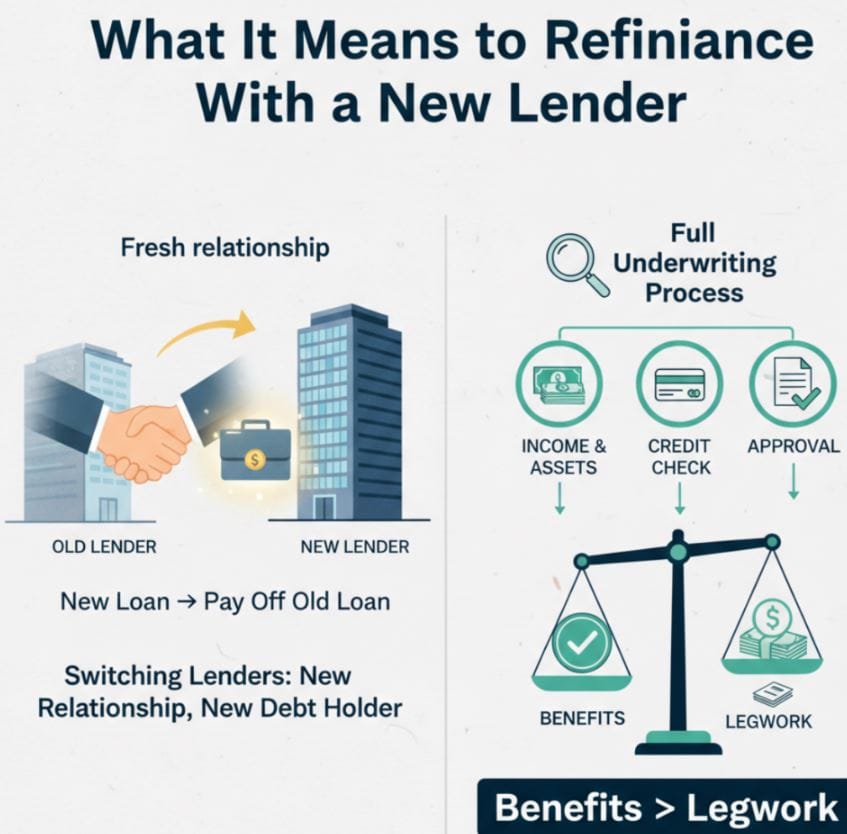

What It Means to Refinance With a New Lender

At its core, refinancing is simply taking out a new loan to pay off an existing one. When you do this with a new lender, you are essentially starting a fresh relationship.

This is different from a “Streamline Refinance” (FHA to FHA) or a simple rate reduction with your current servicer. When you switch lenders, the new institution is buying your debt. They are paying off your old lender in full, and you start making payments to the new one.

Because you are new to them, they can’t just rely on your payment history with the old bank. They need to re-verify that you can afford the loan. This means a full underwriting process—checking your income, assets, and credit. It sounds daunting, but as you’ll see, the benefits often far outweigh the legwork.

Benefits of Refinancing With a Different Lender

Why go through the trouble of applying with a new company? In short: Competition works in your favor.

Lower Rates and Better Loan Terms

Every lender has a different “appetite” for risk and different profit margin targets. On the same day, Bank A might quote you 6.5% while Lender B quotes 5.99% simply because Lender B is aggressively trying to gain market share in your area. By moving to a new lender, you force them to compete for your business.

Access to Specialized Loan Products

Your financial life changes. Maybe when you bought your house, you had a W-2 job and an FHA loan. Now, perhaps you are self-employed or have built up significant equity.

- Removing Mortgage Insurance (MIP/PMI): You might refinance from an FHA loan to a Conventional loan with a new lender to eliminate that monthly mortgage insurance premium.

- Non-QM & DSCR: If you are now a business owner or real estate investor, a traditional bank might say “no” because your tax returns show write-offs. A specialized lender can offer Non-QM (Non-Qualified Mortgage) or DSCR (Debt Service Coverage Ratio) loans that look at bank statements or rental income rather than tax returns.

Lower Fees and Better Service

I’ve seen closing costs vary by $3,000 to $5,000 between lenders for the exact same rate. Some lenders charge “Origination Fees,” while others waive them entirely. Furthermore, online-first lenders or specialized brokerages often have faster turnaround times than big-box banks.

Step-by-Step Guide to Refinancing With a Different Lender

Refinancing isn’t rocket science, but it is a process. Here is the roadmap I use with my clients to ensure nothing falls through the cracks.

Step 1 – Shop Around and Compare Multiple Lenders

This is the single most important step. The Consumer Financial Protection Bureau (CFPB) suggests that borrowers who get three quotes save an average of $3,000 over the life of the loan.

You need to compare:

- Interest Rate vs. APR: The APR includes the fees, giving you a truer cost of the loan.

- Origination Fees: What is the lender charging just to do the paperwork?

- Discount Points: Are you paying upfront to lower the rate?

The Smart Way to Shop In the past, “shopping around” meant filling out forms on five different websites and then getting bombarded by 50 spam calls from aggressive sales reps. It was a nightmare.

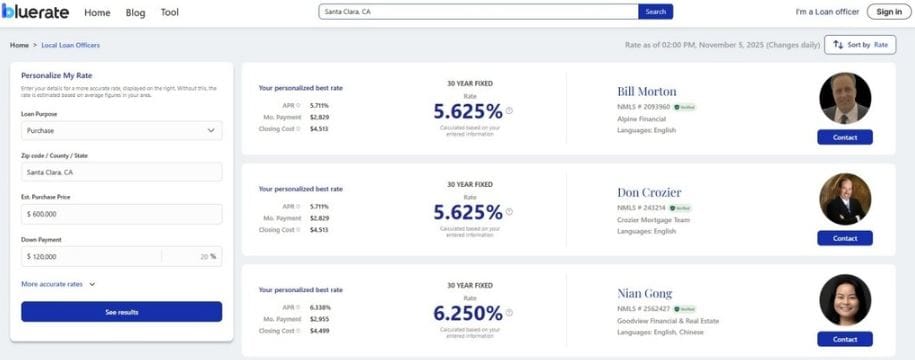

This is where I recommend using Bluerate.ai. It’s an AI Mortgage Marketplace developed by Zeitro that uses AI technology to digitize and streamline the loan origination process. It solves the biggest pain point of rate shopping: privacy and accuracy.

Here is why I prefer Bluerate for my clients:

- Direct Connection, No Middlemen: Unlike generic comparison sites that sell your data as a “lead,” Bluerate connects you directly with a local Loan Officer (LO). You aren’t randomly assigned; you can choose an LO based on their specific experience (like VA loans or Non-QM), their company, and their location.

- Verified Professionals: Every Loan Officer on the platform holds an NMLS certificate. You can even look them up on NMLS Consumer Access to verify their history. Bluerate vets these officers to ensure professionalism and a clean track record, so you can contact them with peace of mind.

- Real Data, No “Teaser Rates”: The platform integrates with nearly 30 mainstream lenders. The rates you see are based on live data, not marketing fluff.

- Personalized Accuracy: You input your specific details—credit score, estimated home value, loan balance, gross income, and monthly liabilities. The AI calculates a Personalized Rate for you, not a generic average for a “perfect” borrower.

- Privacy First: Bluerate does not resell your personal information. You won’t get harassment calls. You initiate the contact when you are ready.

It is completely free to use. You can search, compare scenarios, and when you see a loan officer you like, you contact them directly.

Step 2 – Choose a Lender and Lock Your Rate

Once you’ve selected your lender via Bluerate or your own research, you need to “Lock” the rate. Rates change daily—sometimes hourly—based on the bond market.

- Lock Period: Standard locks are 30, 45, or 60 days. Ensure your lock extends past your expected closing date.

- Float-Down Option: Ask if they offer a “float-down.” This allows you to lower your rate if the market drops significantly after you lock but before you close.

Step 3 – Complete the New Loan Application

You will fill out the Uniform Residential Loan Application (Form 1003). Accuracy here is non-negotiable. Documentation typically required:

- Pay stubs (last 30 days).

- W-2s (last 2 years).

- Bank Statements (last 2 months—all pages, even blank ones).

- For Self-Employed/Non-QM: If you found a Non-QM specialist on Bluerate, you might instead provide 12-24 months of business bank statements or a P&L statement prepared by a CPA.

Step 4 – Underwriting and Appraisal

The Underwriter is the “detective” of the mortgage world. Their job is to verify everything you claimed in Step 3. Simultaneously, the lender will order an appraisal to verify the home’s value.

Step 5 – Review the Loan Estimate (LE)

By law, the lender must send you a Loan Estimate within 3 business days of your application. What to check: Look closely at “Services You Cannot Shop For” (Appraisal, Credit Report) and “Origination Charges.” Compare this document against the initial quote you saw on Bluerate. If the numbers look different, ask why immediately.

Step 6 – Satisfy Underwriting Conditions

It is rare to get a “Clear to Close” immediately. You will likely get a “Conditional Approval.”

Common conditions include:

- Explaining a large deposit in your bank account (to prove it’s not a loan).

- Clarifying a recent credit inquiry. My advice: Respond to these requests within 24 hours. The #1 reason for delayed closings is borrowers taking too long to send missing documents.

Step 7 – Receive the Closing Disclosure (CD)

Three days before you sign the final papers, you will receive the Closing Disclosure. This is the final receipt. Compare the Loan Estimate (from Step 5) to the Closing Disclosure.

- Did the interest rate change?

- Did the closing costs increase?

- Is the “Cash to Close” amount what you expected?

Step 8 – Closing and Payoff of the Current Lender

On closing day, you will sign a stack of papers (often with a notary).

- The Payoff: You do not need to send a check to your old bank. The title company or closing attorney will wire the funds to your old lender to pay off that loan completely.

- The Escrow “Gotcha”: This is a detail many people miss. When you pay off the old loan, your old lender will close your escrow account and refund you the balance (taxes/insurance saved up). However, this refund check usually arrives 15-30 days after closing.

- Why this matters: You will likely need to fund a new escrow account with the new lender at closing. You need to have the cash on hand to do this; you cannot use the refund check from the old loan because it hasn’t arrived yet.

How Long Does It Take to Refinance With a New Lender?

Patience is required, but speed varies by loan type.

- Standard W-2 Borrower: 25 to 35 days.

- Self-Employed / Non-QM: 45 to 60 days (due to complex income analysis).

Conclusion

Refinancing with a different lender is about more than just a lower monthly payment; it’s about optimizing your financial health. Whether you are looking to lower your rate, shorten your term, or cash out equity for a renovation, the benefits of leaving your current lender often far outweigh the administrative effort.

Key takeaways for a smooth process:

- Shop aggressively: Don’t settle for the first offer.

- Organize your docs: Have your financial life in PDF format, ready to go.

- Watch the fees: A lower rate isn’t worth it if the fees are astronomical.

If you are curious about what rates are available to you today but dread the idea of sales calls, I highly recommend starting with Bluerate. It’s the most transparent way to see “what if” scenarios. You can check real-time rates, find a specialized Loan Officer in your area, and make the best choice for your family—all on your own terms.

Remember, in the mortgage world, knowledge isn’t just power—it’s money in your pocket.